Worried you’ll fumble your first online transaction with your Union Bank debit card? Don’t fret! We’re here to guide you through the activation process.

You’ll have your card ready for online shopping in no time. In this article, we’ll navigate the steps together, teaching you how to activate your card safely.

Let’s turn that anxiety into action and prepare your debit card for the digital world!

How to activate your Union Bank debit card for online transactions

Here’s how you’d activate your Union Bank debit card for online transactions.

First, log on to the Union Bank of India’s Internet banking portal. You’ll need your User ID and password handy. Once you’re in, look for a section named ‘Debit Card Services.’ There, you’ll find an option for ‘Debit Card Activation’. Click on it.

You’ll be asked to enter your debit card number, so have it ready. After this, you’ll need to authenticate the activation. This can be done through an OTP sent to your registered mobile number. Enter the OTP correctly, and voila! Your debit card is ready for online transactions.

With this simple process, you can enjoy the convenience of Internet banking with Union Bank of India.

What is a debit card

A debit card’s essentially a plastic payment card that lets you access your bank account directly whenever you make a purchase. You enter your ATM pin, and the amount is immediately deducted from your account. With the vyom app, you can manage your payment channel setting for a smoother transaction experience.

Let’s illustrate this using a simple table:

| Task | How to do it |

|---|---|

| Activating your card | Call customer care with your account number |

| Setting your ATM pin | Use the vyom app or ATM |

| Managing payment channels | Use the vyom app |

| Contacting customer care | Dial the customer care number |

How do I activate my Union Bank debit card

You’re probably wondering how to get your plastic payment tool up and running, right? It’s simple! Union Bank uses a system and method for secure online banking to make this process seamless.

First, you’ll need to log into your online banking account. This utilizes the system and method for authenticating users in an electronic banking system.

Next, navigate to ‘Card Services’ and select your debit card to activate. This is the method and apparatus for authorizing transactions in an electronic banking system.

Finally, follow the prompts to complete the activation process.

You can even activate your card through mobile banking. Union Bank has a system and method for providing mobile banking services that ensure a convenient and secure experience.

Now, you’re all set to use your card for online transactions!

Why do I need to activate my debit card for online transactions

It’s essential to enable your plastic payment tool for web-based purchases to ensure it’s secure and ready to use. This process involves authentication and authorization via your registered mobile number.

When you activate your card for online transactions, you’re taking an extra step toward enhancing your security. This step helps your bank track any fraudulent activity linked to your card. It’s not just about having a functional card; it’s about protecting your hard-earned money.

How to activate your Union Bank debit card for online transactions

Let’s prepare that plastic payment tool for web-based purchases by following simple steps.

Union Bank’s method and apparatus for providing secure electronic banking services involves a system and method for providing risk-based authentication in an electronic banking system.

Here’s what you need to do:

- Sign in to your Union Bank account via your mobile banking services app, or visit the bank’s website.

- Visit the ‘Card Management’ section and choose ‘Activate Card.’

- Follow the on-screen instructions.

Through this, you’re not just activating your card for online transactions but also enabling the system and method for providing bill payment services and the system and method for providing international payments in an electronic banking system.

Once done, you’re all set for a secure online banking experience.

Through internet banking

Through Internet banking, you can quickly and conveniently manage your finances. Union Bank’s system and method for detecting fraud in an electronic banking system ensures you’re always protected. Risk-based authentication adds an extra layer of security, ensuring your money stays where it should.

Union Bank also offers a system and method for providing dynamic currency conversion in an electronic banking system. This feature is handy for international payments. With bill payment services, you can pay your bills on time, every time.

| Service | Description |

|---|---|

| Fraud Detection | Ensures the safety of your account |

| Dynamic Currency Conversion | Useful for international transactions |

| Bill Payment Services | Pay your bills efficiently |

| Risk-Based Authentication | An extra layer of security |

Next, we’ll discuss logging into your Union Bank Internet banking account.

Log in to your Union Bank internet banking account

You’ll need your username and password to access your Internet banking account. Once logged in, you’ll find various services at your disposal.

The system and method for remote deposit capture services are efficient and user-friendly. You can deposit checks remotely without having to visit the bank.

Remote Deposit Capture Services: This feature lets you deposit checks without leaving home.

Dynamic Currency Conversion: You can convert currencies dynamically, a feature especially useful for international transactions.

Security: The system has robust security measures to ensure the safety of your transactions.

Click on the “Debit Card” tab

You’re ready for the next step after successfully logging in to your Union Bank internet banking account.

It’s time to find and click on the ‘Debit Card’ tab. You’ll typically find it nestled among the other tabs on your account homepage, so don’t worry if it’s not immediately visible.

This tab is your gateway to everything related to your Union Bank debit card. By clicking on it, you’re initiating the process allowing you to activate your card for online transactions.

Remember that each step you take brings you closer to having complete control over your financial transactions right from the comfort of your home or office.

Select the “Activate Debit Card for Online Transactions” option

Next, you’ll need to use your card for internet purchases. This option is usually listed as ‘Activate Debit Card for Online Transactions.’ It’s vital to enable your card for online shopping, booking tickets, or any other online payment.

Here are a few reasons why this step is crucial:

- Security: Activating your card for online transactions means the bank can verify your identity during online purchases. It’s an extra layer of protection for your account.

- Convenience: You’ll be able to use your card anytime, anywhere—no need to worry about carrying cash.

- Control: You can manage your spending better and track your purchases easier when using a card online.

Enter your debit card number and PIN

It’s time to input your card number and PIN, ensuring you’re the only one who knows these vital details. The card number is typically 16 digits long and printed on the front of your card. Your PIN, on the other hand, is a secret 4-digit code that you chose when you opened your bank account.

To help you understand better, here’s a table to guide you:

| Field | Description | Example |

|---|---|---|

| Card Number | 16-digit number on the front of your card | 1234 5678 9012 3456 |

| PIN | 4-digit secret code | 1234 |

Click on the “Activate” button

Once you’ve entered those details, you must hit that big button to proceed. This button, typically labeled ‘Activate’, is the final step in enabling your Union Bank debit card for online transactions. It’s that final leap before you can enjoy the convenience of shopping, banking, and making payments at your fingertips.

But before you click, here are a few things to consider:

- Ensure your internet connection is stable. You wouldn’t want to be left hanging, wondering whether your card is active or not.

- Keep your phone handy. Union Bank may send a confirmation message or OTP to your registered mobile number.

- Be patient. Depending on the bank’s server speed, the activation process might take a few minutes or longer.

With these in mind, you’re ready to go. Happy transacting!

Through mobile banking

Mobile banking is a convenient alternative for managing your account and making payments. It’s not only easy to use but also incredibly secure.

With mobile banking, you can activate your Union Bank debit card for online transactions anytime and from anywhere. You don’t need to visit a bank branch or wait in line. Log into your mobile banking account, find the ‘Card Services’ section, and select ‘Activate Card.’ Then, you must follow the prompts and provide the necessary card details. It’s fast, simple, and your card will be activated quickly.

Now that you understand the benefits and the process let’s move on to the next step: how to download the Union Bank mobile banking app.

Download the Union Bank Mobile Banking app

Downloading the mobile banking app is essential for accessing your account from anywhere. You’ll find Union Bank’s mobile banking app in your device’s app store, whether you use iOS or Android. It’s designed to bring banking convenience to your fingertips, allowing you to conduct transactions anytime, anywhere.

Here’s why you should get on board:

- It’s secure: Your account information is protected with high-level encryption.

- It’s convenient: No need to visit a branch for simple transactions.

- It’s efficient: You can check balances, pay bills, transfer funds, and more from your phone.

Now that you know the benefits, you’re one step closer to fully utilizing your Union Bank account. Let’s move on to the next step: Open the app and sign in with your account credentials.

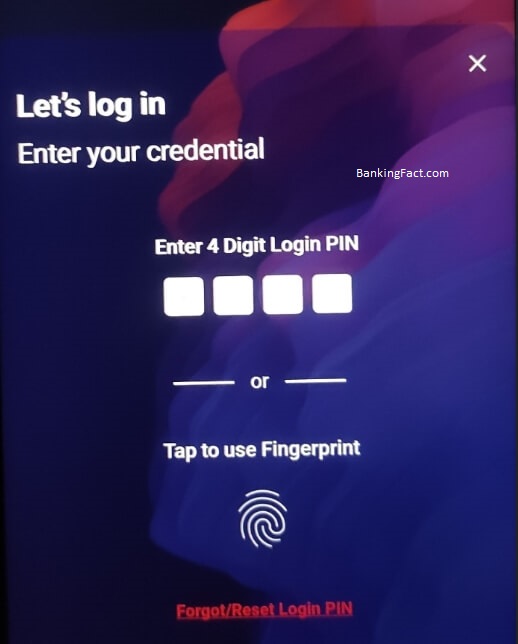

Open the app and sign in with your account credentials

Having downloaded the Union Bank Mobile Banking app, you’re one step closer to activating your Union Bank debit card for online transactions. The next move is to open the app and sign in with your account credentials.

Here’s a simple guide:

| Step | Action |

|---|---|

| 1 | Open the Union Bank mobile app |

| 2 | Enter your username |

| 3 | Enter your password |

| 4 | Tap ‘Sign In’ |

Remember, your username and password are private. Please don’t share them with anyone else. You’re doing great! Following these steps, you can swiftly and securely sign in to your Union Bank account via the mobile app.

Now, let’s move on to the next step, which involves tapping the ‘Debit Card’ tab.

Tap on the “Debit Card” tab

Once you’re logged in, it’s time to tap on the ‘Debit Card’ tab located on the main dashboard. This step is crucial as it’s where you’ll find all the necessary options for your Union Bank debit card. You’re now one step closer to activating your card for online transactions.

- Check Card Status: This is where you’ll find the current status of your debit card. If it’s not active, you won’t be able to proceed with online transactions.

- Activate Card: This option will allow you to activate your card online. You’ll need to follow the prompts carefully to ensure successful activation.

- Manage Card Settings: You can customize your card’s features and settings to suit your banking needs.

Select the “Activate Debit Card for Online Transactions” option

So, you’ve tapped the ‘Debit Card’ tab. Good start! Now, let’s move on to the next step.

You’ll see a variety of options on your screen. Don’t be overwhelmed! You’re looking for one specific option. That’s right; it’s the ‘Activate Debit Card for Online Transactions’ option. It’s a mouthful. But don’t worry; it’s not as complicated as it sounds.

This is the option that’s going to enable you to use your Union Bank Debit Card for online transactions. It’s a handy feature, especially if you love shopping online or often need to make online payments.

Enter your debit card number and PIN

You must now enter your card number and PIN into the corresponding fields. This is a crucial step to verify your identity and to ensure the security of your transactions. Make sure you’re entering the correct information to avoid any issues.

- Your card number is the 16-digit number on the front of your debit card. It’s unique to your account and ensures that the money is deposited into the correct place.

- Your PIN, Personal Identification Number, is a four-digit number you chose when opening your account. It’s another layer of security to confirm it’s you making the transaction.

- If you’ve forgotten your PIN, contact your bank immediately. They can help you reset it.

Once you’ve entered the correct information, you’re ready to move on to the next step: tap on the ‘activate’ button.

Tap on the “Activate” button

Having successfully entered your Union Bank debit card number and personal identification number (PIN), you’re now ready for the final step of the online activation process. You’ll see an ‘Activate’ button on your screen. Don’t hesitate; tap on it.

You’re probably thinking, ‘Is it really that simple?’ Yes, it is! The ‘Activate’ button is your golden ticket to unlocking the full potential of your debit card. It’s a straightforward step but an essential one that confirms your intent to activate your card for online transactions.

Through ATM

You can follow simple steps to get your card up and running if you’re near an ATM. The process isn’t complicated, you need to be aware of the steps and follow them carefully. This method is one of the quickest ways to activate your Union Bank debit card for online transactions.

Here are the steps you need to follow:

- Insert your card into the ATM and enter your PIN.

- Select the ‘Card Services’ option from the menu.

- Choose the ‘Activate Card option.

Remember, it’s important to keep your PIN secure. Don’t share it with anyone; change it immediately if you suspect it’s compromised.

Once your card is activated, you can start making online transactions. Convenient.

Insert your debit card into the ATM

Let’s start by sliding your card into the ATM slot. Ensure you’re doing it correctly, with the strip facing down and towards the machine. If it’s your first time, don’t worry, most ATMs have helpful images and directions on the slot to guide you.

After you’ve inserted your card, the machine will ask for your personal identification number (PIN). Go ahead and carefully enter your PIN using the keypad. Remember, it’s crucial to keep this number confidential.

Now, you’ll see a series of options on the screen. You’ll need to navigate these options to find the one you need. It’s not as daunting as it sounds.

Moving on, let’s delve into the next step – selecting the ‘activate the debit card for online transaction option.

Select the “Activate Debit Card for Online Transactions” option

You’ll need to select the option that allows your card to be used for internet purchases. It’s a critical step to ensure smooth online transactions. Here’s how you go about it:

- Locate the ‘Activate Debit Card for Online Transactions’ option on your ATM screen. This option usually appears after you’ve inserted your card, entered your pin, and accessed the main menu.

- Select this option and follow the on-screen prompts. You might need to confirm your decision, so read everything carefully.

- Once done, your card should be ready for online use. You’ll get a confirmation message on the ATM screen or via SMS on your registered phone number.

Enter your debit card number and PIN

Next, you will enter your card number and PIN, so ensure you have them handy.

The card number is the 16-digit number embossed on the front of your debit card. Be careful not to confuse this with your account number.

The PIN is your Personal Identification Number – a 4-digit secret code you chose when you first got the card. This is confidential info, so never share it with anyone. If you’ve forgotten your PIN, you’ll need to contact Union Bank for assistance.

After you’ve entered these details, double-check them for accuracy. Mistakes can cause delays or problems with the activation process.

You’ll be asked to follow the on-screen instructions as you move forward.

Follow the on-screen instructions

Now, you’re ready to follow the on-screen instructions. Make sure you’re paying close attention to every detail. The process is quite straightforward, but it’s easy to make a mistake if you’re not careful. Remember, this is about your financial security, so don’t rush.

Here are a few key points to keep in mind:

- Always double-check the details you enter. A simple typo can cause unnecessary delays or errors.

- Be wary of any unexpected prompts or requests. During this process, your bank will never ask for your PIN or other sensitive information.

- Finally, make sure you’re on the official Union Bank website. Many phishing sites are out there, so ensuring you’re in the right place is vital.

Through customer care

If you’re having trouble, don’t hesitate to contact customer care for assistance. They’re always ready to help you in real-time. You’ll find them accessible, patient, and knowledgeable about activating your Union Bank debit card for online transactions.

Here’s a table to help you understand the emotions you might experience when contacting customer care:

| Emotion | Reason | Outcome |

|---|---|---|

| Apprehension | Unsure if they can help | Relief after successful assistance |

| Frustration | Struggling with the process | Satisfaction once resolved |

| Impatience | Waiting for a response | Calm after getting help |

Speak to a customer service representative

You’re just one conversation away from resolving your issues when you speak to a customer service representative. These professionals are trained to handle various situations, including helping you activate your Union Bank debit card for online transactions. They’re there to assist, guide, and ensure you have a smooth banking experience.

- Understand the process: The representative will walk you through the steps needed to activate your card, making the process easy and hassle-free.

- Solve problems instantly: If you encounter any issues during the activation process, they can troubleshoot and provide immediate solutions.

- Save time: Instead of struggling alone, a quick call to customer service can activate your card in no time.

Frequently Asked Questions

What Should I Do if I Forgot My Union Bank Internet Banking Account Password?

If you’ve forgotten your Union Bank internet banking password, don’t worry. Just visit the bank’s official website, click on ‘forgot password’, and follow the prompts. You’ll need your account details to reset your password.

Is There Any Fee for Activating the Union Bank Debit Card for Online Transactions?

There’s no fee for activating your Union Bank debit card for online transactions. It’s part of their service to ensure you enjoy easy, secure, fast banking anytime and anywhere.

What if I Entered the Wrong Debit Card Number or PIN During the Activation Process?

If you’ve entered the wrong card number or PIN, it’s like dialing the wrong number—you won’t connect. You’ll need to restart the process, ensuring you input the correct details this time.

Can I Activate My Union Bank Debit Card for Online Transactions if I Am Overseas?

Yes, you can activate your Union Bank debit card for online transactions even if you’re overseas. You need a stable internet connection and access to the bank’s online banking portal.

What Should I Do if My Union Bank Debit Card Is Lost or Stolen?

If you’ve lost your Union Bank debit card or suspect it’s been stolen, immediately contact Union Bank’s customer service. They’ll block your card to prevent unauthorized transactions and guide you through the card replacement process.

Conclusion

So there you have it; taking a leaf from the technology book, you’ve now unlocked the power to activate your Union Bank debit card for online transactions.

No more standing in long lines or waiting on hold. With a few simple steps, you’re now ready to shop, pay bills, and more, all from the comfort of your home.

It’s like having your banker right at your fingertips.